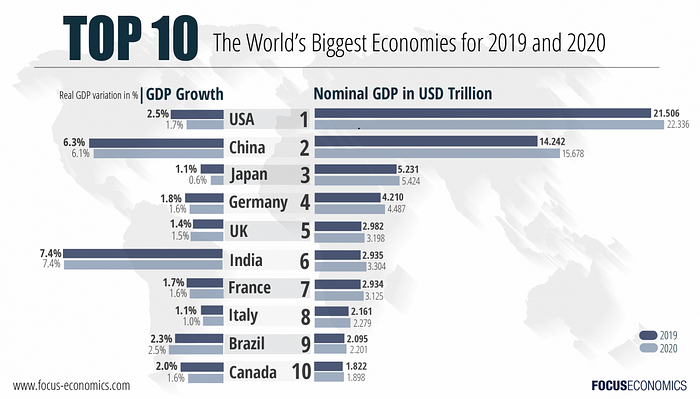

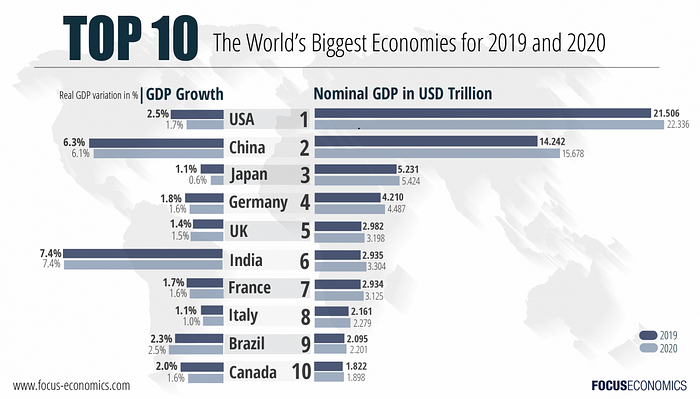

The World's Top 10 Largest Economies

1. United States

Despite facing challenges at the domestic level along with a rapidly transforming global landscape, the U.S. economy is still the largest in the world with a nominal GDP forecast to exceed USD 21 trillion in 2019. The U.S. economy represents about 20% of total global output, and is still larger than that of China. The U.S. economy features a highly-developed and technologically-advanced services sector, which accounts for about 80% of its output. The U.S. economy is dominated by services-oriented companies in areas such as technology, financial services, healthcare and retail. Large U.S. corporations also play a major role on the global stage, with more than a fifth of companies on the Fortune Global 500 coming from the United States. The U.S. economy is projected to grow 2.5% in 2019 and 1.7% in 2020.

2. China

The Chinese economy experienced astonishing growth in the last few decades that catapulted the country to become the world's second largest economy. In 1978—when China started the program of economic reforms—the country ranked ninth in nominal gross domestic product (GDP) with USD 214 billion; 35 years later it jumped up to second place with a nominal GDP of USD 9.2 trillion.

Since the introduction of the economic reforms in 1978, China has become the world’s manufacturing hub, where the secondary sector (comprising industry and construction) represented the largest share of GDP. However, in recent years, China’s modernization propelled the tertiary sector, and in 2013, it became the largest category of GDP with a share of 46.1%, while the secondary sector still accounted for a sizeable 45.0% of the country’s total output. Meanwhile, the primary sector’s weight in GDP has shrunk dramatically since the country opened to the world.

Today the Chinese economy is the second largest in the world and although it experienced massive growth in that 35-year span, authorities have taken a new approach to the economy called the “new normal.” To avoid overheating the economy, authorities are conducting a managed slowdown, which has seen growth gradually slow year after year since 2010. The economy is projected to grow 6.3% in 2019, which is nothing to sniff at, but is a far cry from the over 10% annual growth seen not too long ago.

3. Japan

The Japanese economy currently ranks third in terms of nominal GDP forecast to come in at USD 5.2 trillion in 2019.

Before the 1990s, Japan was the equivalent of today’s China, growing rapidly during the 1960s, 70s and 80s. However, since then, Japan’s economy has not been quite as impressive.

During the 1990s, also termed the Lost Decade, growth slowed significantly, largely due to the burst of the Japanese asset price bubble. In response, authorities ran massive budget deficits to finance large public works projects, however, this did not seem to get the economy out of its rut. A number of structural reforms were then enacted by the Japanese government designed to reduce speculative excesses from financial markets, however, this led the economy into deflation on numerous occasions between 1999 and 2004.

The next measure taken was Quantitative Easing (QE), which saw interest rates go zero and an expansion of the money supply to raise inflation expectations. After a period of not-so-positive results from QE, the economy finally appeared to respond. In late 2005, it outperformed both the U.S. economy and the European Union in terms of economic growth.

Despite what appeared to be a comeback, the economy has largely fallen on hard times since 2008, when it began to show signs of recession for the first time during the financial crisis. Japan’s issues stem largely from unconventional stimulus packages along with subzero bond yields and a fairly weak currency. Economic growth will once again be positive in 2019, however, it is forecasted to below 1% from 2020-2023. For 2018 we project 1.1% percent growth and 1.1% again for 2019.

4. Germany

In the ten years before the great recession, from 1999 to 2008, Germany’s GDP grew 1.6% on average per year. Owing to Germany’s dependence on capital goods exports, the German economy plummeted 5.2% in 2009, as companies around the world scaled back their investment projects in the wake of the financial crisis. The following year, Germany’s economybounced back with a strong 4.0% expansion. The next years were overshadowed by the persistent Eurozone crisis, which dented demand in Europe’s southern countries. As a result, Germany’s economy grew at a lackluster pace annually between 2011 and 2013. The economy has since bounced back, as has the Eurozone economy, and it’ll keep its spot at 4th on the list of largest economies with a nominal GDP of USD 4.2 trillion according to our forecasts for 2019. Analysts see Germany growing 1.8% in 2019, coming in just below 2018’s forecast of 1.9%.

5. United Kingdom

In the 10 years before the Great Recession, from 1999 to 2008, the UK’s gross domestic product grew 2.8% on average per year. As a consequence of overinvestment in the housing market and consumer’s strong dependence on credit, the economy was hit very hard by the financial crisis and the credit crunch. In 2009, GDP fell 5.2%, mainly due to plummeting private fixed investment. However, GDP rebounded in 2010 to a 1.7% expansion. In the three subsequent years, however, growth did not post figures as strong as those before the crisis; average GDP growth was 1.0% in the 2011–2013 period. Since then growth has largely bounced back, however, Brexit uncertainty is still threatening the economy.

Before the referendum many economists and financial institutions projected that the economy would take a hit if the UK voted to leave the EU. Since the Brexit referendum in June 2016, prospects for the UK economy have become highly uncertain, however, the economic Armageddon that was predicted by some has yet to come to fruition. Nevertheless, growth has stuttered and lagged significantly behind the EU average since the start of 2017.

Brexit negotiations between the UK and the EU are yet to be finalized and there is precious little time left to get it done. Growth is likely to slow next year, as private consumption growth dips and fixed investment is dampened by pervasive uncertainty generated by Brexit. However, a stronger external sector and resilient global demand should cushion the slowdown.

The UK will stay in the top 5 largest economies list until 2020, with a nominal GDP of USD 3.2 trillion. Our panelists estimate GDP growth of 1.4% in 2018 and 1.5% in 2019.

6. India

India is projected to overtake both the UK by 2020 to become the fifth largest economy in the world with a nominal GDP of USD 2.9 trillion having overtaken the French economy in 2018.

From 2003 to 2007, India experienced high growth rates of around 9% annually before moderating in 2008 as a result of the global financial crisis. In the following years, India began to see growth slow due to a plunging rupee, a persistently high current account balance and slow industry growth. This was exacerbated by the U.S.’ decision to cut back on quantitative easing, as investors began to rapidly pull money out of India. However, the economy has since bounced back as the stock market has boomed and the current account deficit has decreased. India’s economy recently surpassed China's to become the world’s fastest growing large economy. We forecast India’s growth at 7.4% FY 2019.

7. France

France’s economy will be the seventh largest in the world in 2019, representing around one-fifth of the Euro area gross domestic product (GDP) at USD 2.9 trillion. Currently, services are the main contributor to the country’s economy, with over 70% of GDP stemming from this sector. In manufacturing, France is one of the global leaders in the automotive, aerospace and railway sectors as well as in cosmetics and luxury goods. Furthermore, France has a highly educated labor force and the highest number of science graduates per thousand workers in Europe.

Compared to its peers, the French economy endured the economic crisis relatively well. Protected, in part, by low reliance on external trade and stable private consumption rates, France’s GDP only contracted in 2009. However, recovery has been rather slow and high unemployment rates, especially among youth, remain a growing concern for policymakers.

After a period of volatile growth readings in recent years, growth appears to be finally on a steady track. FocusEconomics Consensus Forecast expect GDP to grow 1.7% in 2019 and 1.6% in 2020.

8. Italy

Italy is the world’s eighth-largest economy, however, the country suffers from political instability, economic stagnation and lack of structural reforms, which are holding it back. Prior to the 2008 financial crisis, the country was already idling in low gear. In fact, Italy grew an average of 1.2% between 2001 and 2007. The global crisis had a deteriorating effect on the already fragile Italian economy. In 2009, the economy suffered a hefty 5.5% contraction—the strongest GDP drop in decades. In 2012 and 2013 the economy recorded contractions of 2.4% and 1.8% respectively, however, the economy has gradually improved in recent years. Nonetheless, it continues to be burdened by numerous long-standing structural problems, including a rigid labor market; stagnant productivity; high tax rates; a large, albeit declining, volume of non-performing loans in the banking sector; and high public debt. These weaknesses restrain the country’s growth potential, keeping its growth outlook below that of its European peers.

FocusEconomics panelists see nominal GDP coming in at USD 2.1 trillion in 2018, increasing 1.3% annually.

9. Brazil

In the 10 years before the global economic crisis, from 1999 to 2008, Brazil’s GDP grew 3.4% on average per year. This growth was driven, in part, by global demand for Brazilian commodities. After experiencing formidable growth in 2007 and 2008, Brazil’s economy shrank 0.3% in 2009 as demand for Brazil’s commodity-based exports fell and foreign credit waned. However, Brazil rebounded strongly the following year, growing 7.5%-the highest growth rate Brazil had experienced in 25 years. Since then, growth has slowed-partially due to rising inflation-and Brazil’s economy grew an average of 2.1% annually from 2011 to 2013.

Since then a combination of the ending of the commodities super cycle, tight credit conditions and political turmoil due to various corruption scandals have kept Brazil’s economy down. However, Brazil keeps its spot in the top 10, albeit one notch lower than last year with Italy projected to overtake it in 2019. The economy is expected to grow 2.3% in 2019 after contracting by over 3.0% just a few years earlier in both 2015 and 2016. Brazil is forecast to have a nominal GDP of USD 2.0 trillion in 2019.

10. Canada

Last but not least we have Canada, the 10th largest economy in the world, just ahead of Russia. From 1999 to 2008, Canada posted strong economic growth and GDP expanded 2.9% annually on average. Due to its close economic ties to the United States, in the crisis-year 2009 Canada’s economy contracted 2.7% over the previous year. Canada did manage to recover quickly from the impact of the crisis, however, thanks to sound pre-crisis fiscal policy, a solid financial system, a relatively robust external sector and the economic strength of its resource-rich western provinces. Since 2010, growth has picked up again and between 2010 and 2013 Canada’s economy expanded 1.4% per year on average. After the end of the commodities super cycle, the Canadian economy took a hit, but it has slowly recovered in recent years.

FocusEconomics panelists expect GDP to come in at USD 1.8 trillion with an annual growth rate of 2.0% in 2019.

(Source: FocusEconomics)